Obama Stimulus Made Economic Crisis Worse

September 26, 2010

Bernanke dares to disagree and says the FED and the government acted and save the world from ‘global meltdown’.

Bloomberg

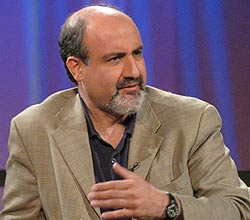

U.S. President Barack Obama and his administration weakened the country’s economy by seeking to foster growth instead of paying down the federal debt, said Nassim Nicholas Taleb, author of “The Black Swan.”

“Obama did exactly the opposite of what should have been done,” Taleb said yesterday in Montreal in a speech as part of Canada’s Salon Speakers series. “He surrounded himself with people who exacerbated the problem. You have a person who has cancer and instead of removing the cancer, you give him tranquilizers. When you give tranquilizers to a cancer patient, they feel better but the cancer gets worse.”

Today, Taleb said, “total debt is higher than it was in 2008 and unemployment is worse.”

Obama this month proposed a package of $180 billion in business tax breaks and infrastructure outlays to boost spending and job growth. That would come on top of the $814 billion stimulus measure enacted last year. The U.S. government’s total outstanding debt is about $13.5 trillion, according to U.S. Treasury Department figures.

Obama, 49, inherited what the National Bureau of Economic Research said this week was the deepest U.S. recession since the Great Depression. Even after the stimulus measure and other government actions, the U.S. unemployment rate is 9.6 percent.

Governments globally need to cut debt and avoid bailing out struggling companies because that’s the only way they can shield their economies from the negative consequences of erroneous budget forecasts, Taleb said.

Errant Forecasts

“Today there is a dependency on people who have never been able to forecast anything,” Taleb said. “What kind of system is insulated from forecasting errors? A system where debts are low and companies are allowed to die young when they are fragile. Companies always end up dying one day anyway.”

Taleb, a native of Lebanon who gave his speech in French to an audience of Quebec business people, said Canada’s fiscal situation makes the country a safer investment than its southern neighbor.

Canada has the lowest ratio of net debt to gross domestic product among the Group of Seven industrialized countries and will keep that distinction until at least 2014, the country’s finance department said in March. Canada’s ratio, 24 percent in 2007, will rise to about 30 percent by 2014. The U.S. ratio, now above 40 percent, will top 80 percent in four years, the department said, citing IMF data.

“I am bullish on Canada,” he told the audience. “I prefer Canada to the U.S. or even Europe.”

Mortgage Interest

Canada’s economy also benefits from the fact that homeowners, unlike their U.S. neighbors, can’t take mortgage interest as a tax deduction, Taleb said. That removes the incentive to take on too much debt, he said.

“The first thing to do if you want to solve the mortgage problem in the U.S. is to stop making these interest payments deductible,” he said. “Has someone dared to talk about this in Washington? No, because the U.S. homebuilders’ lobby is hyperactive and doesn’t want people to talk about this.”

Taleb also criticized banks and securities firms, saying they don’t adequately warn clients of the risks they run when they invest their retirement savings in the stock market.

‘Have Fun’

“People should use financial markets to have fun, but not as a depository of value,” Taleb said. “Investors have been deceived. People were told that markets go up regularly, but if you look at the last 10 years that’s not been the case. The risks are always greater than what people are told.”

Asked by an audience member if returns such as those posted by Berkshire Hathaway Inc. Chief Executive Officer Warren Buffett — who amassed the world’s third-biggest personal fortune through decades of stock picks and takeovers — are the product of luck or talent, Taleb said both played a part.

If given a choice between investing with Buffett and billionaire investor George Soros, Taleb also said he would probably pick the latter.

“I am not saying Buffett isn’t as good as Soros,” he said. “I am saying that the probability Soros’s returns come from randomness is much smaller because he did almost everything: he bought currencies, he sold currencies, he did arbitrages. He made a lot more decisions. Buffett followed a strategy to buy companies that had a certain earnings profile, and it worked for him. There is a lot more luck involved in this strategy.”

Soros gained fame in the 1990s when he reportedly made $1 billion correctly betting against the British pound.

Taleb’s 2007 best-seller, “The Black Swan: The Impact of the Highly Improbable,” argues that history is littered with rare, high-impact events. The black-swan theory stems from the ancient misconception that all swans were white.

A former trader, Taleb teaches risk engineering at New York University and advises Universa Investments LP, a Santa Monica, California-based fund that bets on extreme market moves.