Memos confirm Iraq Invasion was all about Oil

April 19, 2011

The Independent

April 18, 2011

Plans to exploit Iraq’s oil reserves were discussed by government ministers and the world’s largest oil companies the year before Britain took a leading role in invading Iraq, government documents show.

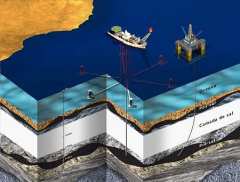

Iraq’s burgeoning oil industry: Click HERE to upload graphic (160k)

The papers, revealed here for the first time, raise new questions over Britain’s involvement in the war, which had divided Tony Blair’s cabinet and was voted through only after his claims that Saddam Hussein had weapons of mass destruction.

The minutes of a series of meetings between ministers and senior oil executives are at odds with the public denials of self-interest from oil companies and Western governments at the time.

The documents were not offered as evidence in the ongoing Chilcot Inquiry into the UK’s involvement in the Iraq war. In March 2003, just before Britain went to war, Shell denounced reports that it had held talks with Downing Street about Iraqi oil as “highly inaccurate”. BP denied that it had any “strategic interest” in Iraq, while Tony Blair described “the oil conspiracy theory” as “the most absurd”.

But documents from October and November the previous year paint a very different picture.

Five months before the March 2003 invasion, Baroness Symons, then the Trade Minister, told BP that the Government believed British energy firms should be given a share of Iraq’s enormous oil and gas reserves as a reward for Tony Blair’s military commitment to US plans for regime change.

The papers show that Lady Symons agreed to lobby the Bush administration on BP’s behalf because the oil giant feared it was being “locked out” of deals that Washington was quietly striking with US, French and Russian governments and their energy firms.

Minutes of a meeting with BP, Shell and BG (formerly British Gas) on 31 October 2002 read: “Baroness Symons agreed that it would be difficult to justify British companies losing out in Iraq in that way if the UK had itself been a conspicuous supporter of the US government throughout the crisis.”

The minister then promised to “report back to the companies before Christmas” on her lobbying efforts.

The Foreign Office invited BP in on 6 November 2002 to talk about opportunities in Iraq “post regime change”. Its minutes state: “Iraq is the big oil prospect. BP is desperate to get in there and anxious that political deals should not deny them the opportunity.”

Read Full Article…