When the Crisis comes… Kick the Can Down the Road…

October 28, 2011 1 Comment

The Economic Collapse

October 28, 2011

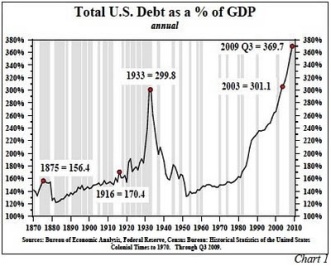

Have you heard the good news? Financial armageddon has been averted. The economic collapse in Europe has been cancelled. Everything is going to be okay. Well, actually none of those statements is true, but news of the “debt deal” in Europe has set off a frenzy of irrational exuberance throughout the financial world anyway. Newspapers all over the globe are declaring that the financial crisis in Europe is over. Stock markets all over the world are soaring.

The Dow was up nearly 3 percent today, and this recent surge is helping the S&P 500 to have its best month since 1974. Global financial markets are experiencing an explosion of optimism right now. Yes, European leaders have been able to kick the can down the road for a few months and a total Greek default is not going to happen right now. However, as you will see below, the core elements of this “debt deal” actually make a financial disaster in Europe even more likely in the future.

The two most important parts of the plan are a 50% “haircut” on Greek debt held by private investors and highly leveraging the European Financial Stability Facility (EFSF) to give it much more “firepower”.

Both of these elements are likely to cause significant problems down the road. But most investors do not seem to have figured this out yet. In fact, most investors seem to be buying into the hype that Europe’s problems have been solved.

There is a tremendous lack of critical thinking in the financial community today. Just because politicians in Europe say that the crisis has been solved does not mean that the crisis has been solved. But all over the world there are bold declarations that a great “breakthrough” has been achieved. An article posted on USA Today is an example of this irrational exuberance….

Investors — at least for now — don’t have to worry about a financial collapse like the one in 2008, after Wall Street investment bank Lehman Bros. filed for bankruptcy, sparking a global financial crisis.

“Financial Armageddon seems to have been taken off the table,” says Mark Luschini, chief investment strategist at Janney Montgomery Scott.

Wow, doesn’t that sound great?

But now let’s look at the facts.

Read Full Article…