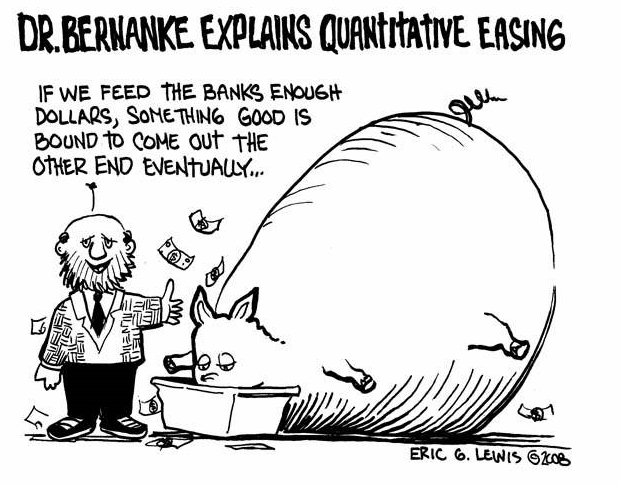

Quantitative Easing Explained

December 22, 2010

QE and QE2 have absolutely nothing to do with “saving” the economy. However, QE3 has already been announced.

By Eric Woodell

The massive “quantitative easing” by the Federal Reserve, sounds somewhat noble, even gentle, in its approach to helping restore the American economy. Such terms almost sound like you suddenly can refinance your house for an absurdly low rate, it’s that easy.

But the reality is quite different.

The Federal Reserve has the ability to create money. In the old days, that meant using printing-presses, to put ink on paper, which are then called “dollars.” Nowadays, however, they do it with literally the click of a computer keyboard, and the money is created instantly! Pretty cool, don’t you think?

But what does this really mean?

Why would the Federal Reserve do this, and devalue the dollar? After all, if there are only a certain number of goods available, and everyone suddenly has twice as much money, won’t the prices of everything double, and the net result will be that nothing has effectively changed? Won’t the only real change be that each unit of currency being worth exactly half of what it was?

The answer to both questions, of course, is “yes.” But what matters, is who gets the money first. In the academic study of economics, this could be termed the “first-mover” advantage.

Let’s use an analogy: Let’s assume the economy had $3 trillion floating around in it. Now, suppose the Fed gave you $1 trillion dollars, in your own personal checking account. With that much money, what would you do? Pay off all your debts, buy a nice car and new house, and so on… In other words, you could spend that money, at the value it currently is at. Of course, as you bought more stuff, more money will make it into the general economy, increasing the money circulating around, and eventually the dollar will have a lower value. In this case, after you’ve spent all the money acquiring everything worth buying, there would now be $4 trillion in the economy, instead of $3 trillion. If you spent all of that money in one year, the inflation rate would be 4/3, or 33%. The dollar would be worth only ¾ of what it had, just the previous year.

The effect to everyone else in the economy, is that their money is worth less than the previous year, and if you had your money tied up in a savings account paying 3% interest, it would mean you actually lost 30% in one year, because the dollars you have in your bank purchase that much less. This has the net effect of being a government tax, while at the same time, allowing the cronies and suck-ups of the Fed to gain power, by taking it from you.

This is why the Fed constantly wants inflation; it gives them power over you, invisibly taxes you, and allows them to maintain power over you.

When they talk about more “quantitative easing,” like QE2 or even QE3, it means that the Fed is robbing you of your ability to purchase things like food, fuel or shelter. Instead, the money is sent to the favorite banks of the Fed (remember, the Federal Reserve is a private corporation, made up of… banks). Which really means, they give it to themselves.

As you can now see, QE and QE2 have absolutely nothing to do with “saving” the economy. Indeed, the opposite is the truth. The actions by the Fed make the continued degradation of economic situation of the USA a certainty.

When more Americans finally wake up, and understand the rampant theft that’s being committed by the Federal Reserve and their cronies, there will be Hell to pay.