Banks in Debt?

April 14, 2011

Most of this “debt” is part of the purchase and investment on toxic financial products the banks themselves created as well as unpaid real estate mortgages

Reuters

April 14, 2011

The world’s banks face a $3.6 trillion “wall of maturing debt” in the next two years and must compete with debt-laden governments to secure financing, the IMF warned on Wednesday.

Many European banks need bigger capital cushions to restore market confidence and assure they can borrow, and some weak players will need to be closed, the International Monetary Fund said in its Global Financial Stability Report.

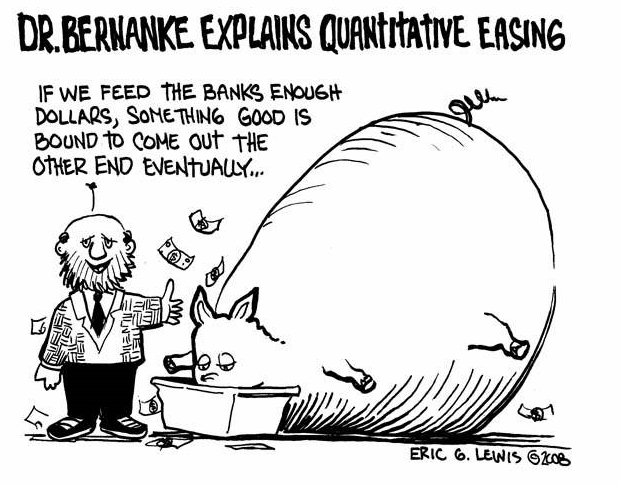

After creating toxic financial products, loan schemes and other scams, banks requested to be bailed-out with taxpayer money.

The debt rollover requirements are most acute for Irish and German banks, with as much as half of their outstanding debt coming due over the next two years, the fund said.

“These bank funding needs coincide with higher sovereign refinancing requirements, heightening competition for scarce funding resources,” the IMF said.

Overall, the IMF said global financial stability has improved over the past six months.

The most pressing challenges in the coming months will be funding of banks and sovereigns, particularly in vulnerable euro area countries, it said.

The IMF and European Union bailed out Greece and Ireland, and are in talks with Portugal on a lending program as sovereign borrowing costs surge.

Many investors have questioned whether Spain can avoid a similar fate, but the IMF said Spanish authorities were taking the right steps to address the country’s debt problems.

“The actions that have been taken in Spain recently have managed to decouple, in the views of markets, the fortunes of Spain relative to those of Portugal” and Ireland, said Jose Vinals, director of the IMF’s Monetary and Capital Markets Department.

European banks hold large amounts of euro zone sovereign debt, making them vulnerable to losses if countries are forced to restructure.

Vinals said lending programs in Greece and Ireland were built on the assumption there would be no such restructuring, and the programs needed time to work.

Still, worries about bad debt exposure have heightened investor concerns about bank balance sheets, making it even more important for firms to shore up their capital.

US banks built up capital buffers in 2009, when regulators completed a set of stress tests that revealed some large holes.

But European banks still need to raise a “significant amount of capital” to regain access to funding markets, the fund said.

“It is … imperative that weak banks raise capital to avoid a pernicious cycle of deleveraging, weak credit growth, and falling asset prices,” it warned.

Living Dangerously

The European Central Bank’s upcoming stress tests provide a “golden opportunity” to improve bank balance sheet transparency and reduce market uncertainty about the quality of assets on banks’ books, the IMF said.

European banks won’t be able to obtain all the necessary capital from markets, and public money may have to fill some of the gaps, it added.

Banks could also cut dividends and retain a larger portion of earnings.

“Overall, a comprehensive set of policies — including capital-raising, restructuring and where necessary resolution of weak banks, and increased transparency about banking risks — is needed to solve banking system vulnerabilities,” it said.

“Without these reforms, downside risks will re-emerge.” The IMF said banks’ exposure to troubled sovereign debt is “uncertain,” which adds to the funding strains.

It said government debt was generally high and on a worrying upward path in many advanced economies.

It repeated its warning that the United States and Japan faced particularly dangerous debt dynamics.

Advanced economies were “living dangerously” with high debt burdens, and faced the difficult task of trying to pare deficits without choking off the economic recovery.

The fund said government interest bills would likely rise, although the burden should generally remain manageable provided countries proceed with deficit reduction plans.

For 2011, Japan and the United States face the largest public debt rollovers of any advanced economy at 56 percent and 29 percent of gross domestic product, respectively.

“While the United States and Japan continue to benefit from low current (borrowing) rates, both are very sensitive to a potential rise in funding costs,” it said.