Do away with Reserve Currencies and Centralized Financial Control

September 13, 2012

By LUIS MIRANDA | THE REAL AGENDA | SEPTEMBER 13, 2012

For way too many years, the United States has enjoyed an unfair advantage with respect to the rest of the world: most international commerce is conducted in US dollars. Both friends and foes of the US have had to purchase raw materials, parts, finished products, pay tariffs and exchange rates in dollars because the world saw the American currency as a strongly positioned instrument that was backed by the economic and military might of the United States.

The result of having a reserve currency, both for the US and for the rest of the world is clear: Americans have enjoyed decades of bounty because almost anything that is necessary to live is paid for and purchased in US dollars. From crude oil to food staples, countries and companies use the US dollar to complete most commercial transactions. But the bounty for Americans was not the only consequence — or goal, depending how you see it. Because the US dollar was the reserve currency of the world, its value was kept artificially high. People, companies and other countries bought US dollars to use them in their daily activities such as traveling expenses, for example.

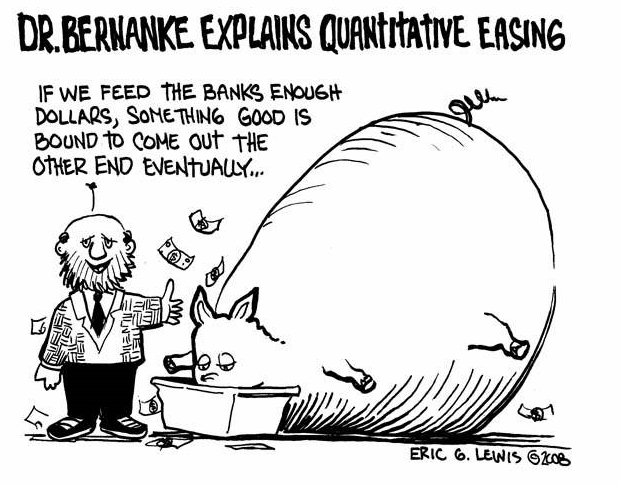

The value of the currency, especially a fiat one like the US dollar is artificial because after the central bank decides to print money beyond what a country produces — GDP — in order to run a debt-based economy, it is just a matter of time before the wheels of the truck come off. In the case of the United States, three and a quarter of the four wheels have already fallen off. The US currency has been hyper-inflated in a controlled manner since the creation of the Federal Reserve System, which is the same system of centralized power used in almost every single nation in the world; no matter if it’s a developed, developing or underdeveloped country.

Today, the value of the dollar, the Euro, the Peso or the Real do not represent the capacity of a country to produce, innovate and sell goods in local, regional or international markets through bilateral or multilateral agreements. The value of currencies is set by banking institutions and then freely manipulated by artificially-managed markets, not real capitalism or free markets.

The kind of “commercial contract” that helped the US to sets its currency as the “world reserve currency” and that provided the unfair advantage against its business partners and competitors is now reaching its end. The rise of China as one of the largest producers of finished products — through questionable standards to say the least — along with the economically weaker position of the United States in the world stage, has prompted nations to seek alternative forms of completing commercial transactions that do not use US dollars. United States competitors, especially those who lend money to the country, realized that the United States will most likely default on its debt or will simply pay with a devalued currency which will not be worth much, so they’ve decided to use their own currencies instead of the US dollar.

For example, China and Russia have closed several agreements to realize commercial transactions in their own currency as supposed to using dollars. The Chinese and the Russians, it seems, learned that by using the Yuan and the Ruble, they are not only valuing their currencies, but are also avoiding to pay the “dollar tax”, or the cost of having to buy and sell in US dollars, which had kept them in a competitive disadvantage against their commercial and military foe.

The devaluation of the dollar due to banking manipulation conducted by the Federal Reserve or the weakening of the currency in international markets — is bad news for the US and the American people, because it means that if the dollar fails to keep its status as the reserve currency, everything will be more expensive for them: raw materials, food, energy, interest rates, etc. But worse than all of that is that the demand for US dollars in the world will significantly decrease, which in itself will turn the dollar into a less attractive way to pay for and sell goods and services.

The loss in value of the American currency will also worsen another problem: the US debt. The US has been for a long time the best debtor nation in the world, for its lenders thought that since the country had the world’s reserve currency would guarantee that their loans would be paid in full. But now, reality shows otherwise. The fall of the US dollar from the pedestal of “world reserve currency” will also make it more expensive for the US to pay its current debt as well as the debt it will incur into in the coming years and decades. The weaker the dollar is, the more expensive it becomes for the US to pay its debts. This scenario is now seen in Spain, Greece, Italy and Portugal, who have handed their sovereignty to foreign banking institutions in exchange for “financial rescues”.

Although common wisdom would suggest that US indebtedness with China would be the worst possible situation while the dollar declines, there is actually a worse scenario and it does not involve China. The US main lender is not China anymore, but the Federal Reserve Banking System, a private institution that represents the interests of an international banking consortium located abroad, not in the United States.

The banking mafia will continue to willingly lend to the US because all debt created by the Federal Reserve in the name of the United States and its people will always have a way to be paid. The United States, just as many other countries in the world do, mortgage the lives of present and future people by taxing them to death in order to pay interests on the ever exploding debt. This ‘trust’ that the banking institutions have in the United States and other nations can only be broken if the US dollar fails as the world reserve currency. That is why the European bankers have created parallel fiat currencies such as the Euro, which they also intend to collapse in order to establish a sort of electronic untraceable form of currency.

At the same time and while it is still possible, wealthy individuals who have made their fortunes through deceitful practices, such as George Soros, as well as governments have begun a race to get rid of their dollar reserves — a fact that also weakens the US currency — and invest in gold, rare metals, silver and other valuable instruments. The divestment of funds from US dollars to other currencies or valuable metals or materials threatens to accelerate the fall of the once strong world reserve currency.

The decline of the US dollar has emboldened countries like China to seriously consider letting its currency fluctuate freely in the open market. This practice is set to begin at some point in 2015 and will continue until 2017, the Chinese have said. Do the Chinese feel that by 2015 the dollar will be weak enough that it won’t be able to directly compete with the Yuan? Perhaps. But in a financial world where almost everything is fake, there is no reason to believe that the American government or the banking institutions that it represents will not come up with a way to slow down or stop the collapse of its currency. Many financial experts expect the opposite, though. Some of them even believe that the collapse of the dollar will happen some time between the Winter of 2012 and the Spring of 2013.

If there is one thing the world has learned is that independent nation-states that establish commercial agreements in a bilateral or multilateral fashion are better off that those which are prisoners of a common currency with a centralized financial power system. The only reason why the world is dominated by common currencies and so-called unions is because those schemes facilitate monopolies and control, which is what the international banking mafia wants. The Euro is a clear example of how monopoly works perfectly well when a group of oligarchs intends to artificially create economies to later collapse them so that they can consolidate power. It works beautifully. For the rest of us, let’s do away with reserve currencies that provide unfair advantages as well as centralized power that only renders benefits for the Anglo-Saxon power elite.