Europe: From the Subprime to the Breakdown

August 10, 2012 1 Comment

By LUIS MIRANDA | THE REAL AGENDA | AUGUST 10, 2012

The storm that began in the U.S. five years ago, swept governments, banks and mortgage financiers.

The outbreak of the subprime mortgage crisis in the U.S. arrives to its fifth year with a legacy that includes a global economic crisis that seems endless: the almost certain breakdown of the euro, and in the case of Greece, Spain, and most likely France, Portugal and Italy , among others, the need to seek bailouts from the European Union.

After five years, Greece is no longer owned by its people, but by bankers. The country experienced a total collapse since the alarm bells went off on August 9, 2008. The same has happened to Spain, that went from a growth rate of 4% to a negative one which is expected to be 1.5% in 2012. As it happened in other sovereign debt stricken countries, Spain lost half of its stock market value — not that it really means anything in the real world — and corporate profits, depending on who you ask, have seen dramatic losses or dramatic gains.

Almost all Euro zone countries have seen their ability to request loans erased or deeply eroded, given their loss of reputation as trustworthy borrowers. That fact has also made it more expensive for nations to pay for the already existing debt, which turned attention to their leaders. In response to the fiscal challenge, governments simply decided to continue business as usual, that is, borrowing more money at higher interest rates, in order to finance the gigantic welfare systems they do proudly own. Through the years, the deficit has grown, and so has the debt and the interests on it. The sovereign debt bubble, to use a familiar term, is that much closer to burst, given countries like Spain’s inability to make the payment on its debt, while continue to borrow.

The negative of the European governments to act in accordance with the best interests of their people, resulted in more unemployment, more debt, less production, and less sovereignty. In the Euro zone, most countries have been downgraded by the banker created rating agencies, such as Fitch and Moody’s which resulted in the increase of borrowing costs.

The risk premium, index of investor confidence in the sovereign debt of a country is measured by the spread between ten-year national bond and the German for the same period, went from complete anonymity to becoming the essential indicator for all economies. In August 2007 the risk premium of Spain, for example, which is the measure of the extra costs demanded by investors for buying Spanish sovereign debt compared to Germany, was 12 basis points, compared to the 630 points it has now.

Even though the subprime crisis was rooted in the United States, where all kinds of schemes were created to defraud borrowers, lenders, families and investment funds, the shock waves rapidly arrived in Europe, where big banks had invested themselves — knowingly and otherwise — in the same fraudulent financial products stained with the subprime lending scam. One of the triggers of the crisis in Europe was the temporary suspension of the liquid value of three funds owned by BNP Paribas on August 9, 2007. This move was a direct consequence of the subprime mortgage debacle in the U.S., where investing firms used customer money to gamble, while their risk was minimum. From every $100 that was put at risk, $97 belonged to pension funds, credit unions , retirement accounts and average investors. Only $3 came out of the pockets of those who risked their customers’ assets.

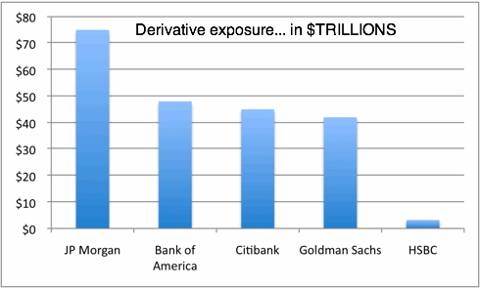

In most cases, unregulated U.S. financial institutions diversified the risks of subprime mortgage loans through securitization, transferring them to other banks in the credit derivatives market. Derivatives are themselves a form of artificially created ‘financial products’ with little or no value. The lack of transparency and little clarity in the terms of the derivative contracts make this financial instrument the most attractive, but also the riskiest one. In the case of the crisis of 2008, investors only got to know the risk and not the promised high returns in their investments. That is how many individuals, companies and organizations saw their monies simply disappear. Someone had simply ran away with their money.

The supposed harmless securitizations involved the transformation of an asset or a non-negotiable right to payment (eg. a mortgage) into homogeneous debt securities or bonds, standardized and open to negotiation on organized securities markets. Financial institutions took on the risk for two reasons. First, because it was not their money the one at risk, but that of investors. Second, because they knew that government would come to the rescue, as it has now happened. The immediate impossibility to know the total value of these toxic assets and who was exposed to them launched even worse tsunami waves that deepened the crisis to levels never seen before.

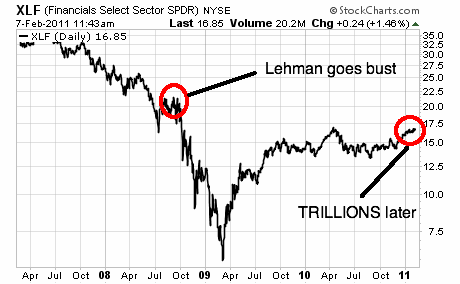

The contagion in financial markets collapsed and worked as the perfect excuse for the European Central Bank (ECB), U.S. Federal Reserve and other central banks to take initiate the largest transfer of wealth ever seen in history. Not only had the banks ran away with investors’ money, but they were also about to receive the largest taxpayer funded bailouts ever — which are still ongoing — even though they were the only ones to blame for the collapse of the existing system. Total bailout cash has now reached $1 trillion and this money has mostly been given to selected people in governments as well as international banking institutions. It is important to note that some calculations set the fraudulent derivative market value at $1 quadrillion.

Right at the beginning of the crisis, and in one transaction alone, the European Central Bank gave away 94.841 million euros, one third more than the 69,300 million euros injected on 12 September 2001, a day after the attacks in New York. This move meant little or nothing as the connections in a globalized economy began to reveal that the problems were just about to get worse. The storm started by some U.S. mortgage financing firms became a gale that has so far crushed governments like Greece, Italy and France, mortgage financing giants Fannie Mae and Freddie Mac and investment banks like Bear Stearns and Wall Street’s Lehman Brothers. Those two banks along with many others were literally absorbed and digested by bigger banks, that with taxpayer money, healed all losses they would have and still were left with much more cash to pay fat bonuses to their corporate leaders.

The crisis has gotten to a point where it has mathematically bankrupted almost all if not all developed countries — even though their leaders say otherwise — due to the impossibility for those nations to pay off their debts. Their implosion is just a matter of time. With Spain, France and Italy being unable to meet their obligations and not willing to seek sane fiscal and monetary policies, the break up of the Euro zone is all but imminent. As mentioned in previous articles, the length of time that will pass until the full collapse occurs is in the hands of the banking institutions who originally caused the crisis.

The financial crisis of confidence and credit has led to recession after another in the developed world and has slowed the growth in emerging markets like Brazil or China, but mostly has jeopardized the survival of the single European currency. The effects of the crisis remain to be seen in those regions of the world, where their economies have begun to contract already.

The underclass as well as the dumbed down middle-class that for centuries sucked off the system through government established dependence programs only woke up after finding themselves with no jobs, no pension, no savings and no future. They woke up from their eternal state of slavery because the bribery scheme known as welfare that the government used to hook them up is suddenly crashing down, and they have not safety net to fall onto. What do I mean by bribery scheme? In 2007, the richest country in the planet had at least 52.6 percent of the people receiving government aid of some sort: pensions, social security and so on.. One in five Americans held a government job or a job that depended on government spending. Around 19 million used food stamps and 2 million got subsidized housing. If that is not government bribery, I don’t know what is it. The social engineers made sure from the start that only two classes existed: the productive class and the parasitical class. Both the government and the dependent classes are equally violent towards those who produce and who support them throughout their lives.

The underclass as well as the dumbed down middle-class that for centuries sucked off the system through government established dependence programs only woke up after finding themselves with no jobs, no pension, no savings and no future. They woke up from their eternal state of slavery because the bribery scheme known as welfare that the government used to hook them up is suddenly crashing down, and they have not safety net to fall onto. What do I mean by bribery scheme? In 2007, the richest country in the planet had at least 52.6 percent of the people receiving government aid of some sort: pensions, social security and so on.. One in five Americans held a government job or a job that depended on government spending. Around 19 million used food stamps and 2 million got subsidized housing. If that is not government bribery, I don’t know what is it. The social engineers made sure from the start that only two classes existed: the productive class and the parasitical class. Both the government and the dependent classes are equally violent towards those who produce and who support them throughout their lives.