Los Cuatro Jinetes de la Banca Mundial

May 27, 2011

Si a usted le es difícil entender que es el Nuevo Orden Mundial -en realidad es el antiguo orden mundial- y quienes lo componen, este es el artículo para aclarar sus dudas.

Por Dean Henderson

Traducción Luis R. Miranda

27 de mayo, 2011

Si quieres saber dónde está el centro de poder real del mundo, sigue el dinero – cui bono. Según la revista Global Finance, a partir de 2010 los más poderosos bancos se encuentran en los feudos de Rothschild en el Reino Unido y Francia.

Ellos son los franceses BNP ($ 3 trillones de dólares en activos), Royal Bank of Scotland ($ 2,7 trillones de dólares en activos), el HSBC Holdings con sede en el Reino Unido ($ 2,4 trillones de dólares en activos), el francés Credit Agricole (2,2 trillones de dólares en activos) y el Barclays británico (2,2 trillones en activos).

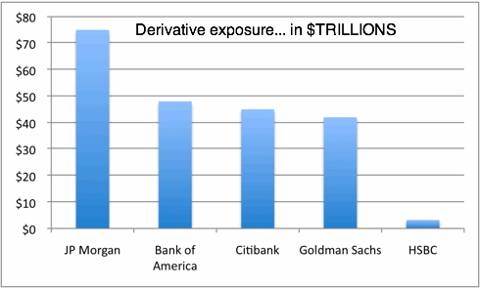

En los EE.UU., una combinación de desregulación y la manía de las fusiones bancárias ha dejado a cuatro mega-bancos como jefes del sistema financiero. Según Global Finance, a partir de 2010 son Bank of America (2,2 trillones de dólares), JP Morgan Chase ($ 2 trillones de dólares), Citigroup ($ 1.9 trillones de dólares) y Wells Fargo ($ 1.25 trillones). Los he llamado los Cuatro Jinetes de la banca de EE.UU. La consolidación del Poder del Dinero.

En septiembre de 2000 el matrimonio que creó JP Morgan-Chase fue la más grande concentración en un frenesí de consolidación bancaria que se llevó a cabo a lo largo de la década de 1990. La manía de concentraciones fue alimentada por una desregulación masiva de la industria bancaria como la revocación de la Ley Glass Steagal de 1933, que fue promulgada después de la Gran Depresión para frenar los monopolios bancarios que habían causado el crack bursátil de 1929 y que precipitó la Gran Depresión.

En julio de 1929 Goldman Sachs lanzó dos fondos de inversión llamado Shenandoah y el Blue Ridge. Durante agosto y septiembre de ese año, los bancos promocionaron estos fideicomisos al público, la venta de cientos de millones de dólares en acciones a través de Goldman Sachs Trading Corporation a $ 104 dólares cada acción. Los inversionistas de Goldman Sachs fueron rescatados en el mercado de valores. En el otoño de 1934 las acciones tenían un valor de $ 1.75 dólares cada una. Un director de Shenandoah y Blue Ridge y abogado de Sullivan & Cromwell, era John Foster Dulles. [1]

John Merrill, fundador de Merrill Lynch, salió del mercado de valores en 1928, al igual que lo hicieron inversionistas de Lehman Brothers. El presidente de Chase Manhattan, Alfred Wiggin tuvo una “corazonada”, al formar la Corporación Shermar en 1929, para atacar las acciones de su propia compañía. A raíz de la crisis de 1929, el presidente de Citibank, Charles Mitchell, fue encarcelado por evasión de impuestos. [2]

En febrero de 1995 el presidente Bill Clinton anunció sus planes para acabar con Glass Steagal y la Ley Bank Holding Company de 1956 – que prohibía a los bancos poseer compañías de seguros y otras entidades financieras. Ese día el comerciante de opio y esclavos, Barings, quebró después de que uno de sus operadores con sede en Singapur llamado Nicholas Gleason quedó atrapado en el lado equivocado de miles de millones de dólares en operaciones de derivativos. [3]

La advertencia no fue escuchada. En 1991, los contribuyentes de EE.UU., que ya habían tenido que pagar más de $ 500 mil millones de dólares al S & L, tuvieron que pagar otros 70 mil millones de dólares para rescatar a la FDIC, y poco después pagaron la factura de un rescate secreto dos años y medio de Citibank, que fue al borde del colapso después de la crisis de deuda en América Latina. Con sus cuentas ya pagadas por los contribuyentes de EE.UU. y la desregulación bancaria dada por un hecho, el escenario estaba listo para una gran cantidad de fusiones bancarias como el mundo nunca había visto.

El subsecretario del Tesoro de Reagan, George Gould ha afirmado que la concentración de la banca en cinco a diez bancos gigantes era necesario para la economía de los EE.UU. La visión de Gould estaba a punto de hacerse realidad.

En 1992, Bank of America compró a su rival más grande de la costa oeste, Security Pacific, para después tragarse al Banco Continental de Illinois. Bank of America más tarde adquirió una participación del 34% del banco Black Rock (Barclays posee el 20% de Black Rock) y una participación del 11% en China Construction Bank, haciendola la segunda mayor compañía bancaria del país, con activos de $ 214 mil millones de dólares. Citibank controlados 249 mil millones dólares. [4]

Ambos bancos han incrementado sus activos a alrededor de 2 trillones dólares cada uno.

En 1993, Chemical Bank absorbió el Commerce Bank de Texas para convertirse en el tercer mayor banco comercial con $ 170 mil millones de dólares en activos. Chemical Bank se había fusionado ya con Manufacturers Hanover Trust en 1990.

North Carolina National Bank y Sovran C & S se fusionaron y formaron el Nation Bank, para convertirse en la cuarta mayor compañía bancaria de EE.UU. con 169 mil millones de dólares en sus arcas. Fleet Norstar compró el Banco de Nueva Inglaterra, mientras que Norwest compró Bancos Unidos de Colorado.

A lo largo de este período los activos bancarios de estas empresas batieron récords cada trimestre. El año 1995 batió todos los récords anteriores desde las fusiones bancarias. Negocios entre bancos ‘produjeron’ un total de 389 mil millones de dólares. [5]

Los Cinco Grandes Bancos de Inversión, que acababan de ganar toneladas de dinero direccionando negociaciones de la deuda de América Latina, multiplicaron sus ganancias a través de la interminable lista fusiones entre 1980 y 1990.

De acuerdo con Standard & Poors los más poderosos bancos de inversión eran Merrill Lynch, Goldman Sachs, Morgan Stanley Dean Witter, Salomon Smith Barney y Lehman Brothers. Un acuerdo que fracasó en 1995 fue una propuesta de fusión entre el mayor banco de inversión de Londres, SG Warburg y Morgan Stanley Dean Witter. Warburg eligió Union Bank de Suiza como su pretendiente en su lugar, y de ahí surgió UBS Warburg como la sexta fuerza en la banca de inversión.

Después del frenesí de 1995, los bancos se movilizaron agresivamente hacia el Oriente Medio, y establecieron operaciones en Tel Aviv, Beirut y Bahrein, donde la flota de bancos de EE.UU. se instaló. Las privatizaciones del Banco en Egipto, Marruecos, Túnez e Israel abrió la puerta a los mega-bancos a esas naciones. Chase y Citibank, pidió dinero prestado a Royal Dutch Shell y Petroquímica de Arabia, mientras que JP Morgan asesoró al consorcio liderado por Qatargas Exxon Mobil. [6]

La industria mundial de seguros también tenía un caso de manía por las fusiones. En 1995, Traveler’s Group había comprado Aetna, y Berkshire Hathaway -una empresa de Warren Buffet- había absorbido Geico, Zurich Seguros absorbió Kemper Corporation, CNA Financial había comprado Continental Companies y General Re Corporation había hundido sus dientes en Colonia Konzern AG.

A finales de 1998 el coloso Citibank se fusionó con Travelers Group para convertirse en Citigroup, la creación de un gigante de un valor de $ 700 mil millones que se jactaba de tener 163.000 empleados en más de 100 países que incluía a las empresas de Salomon Smith Barney (una empresa conjunta con Morgan Stanley), crédito comercial, Primerica Financial Services, Shearson Lehman, Barclays América, Aetna y Financial Pacific Segurities. [7]

Ese mismo año, Bankers Trust y U.S. Investment Bank Alex Brown fueron adquiridos por Deutsche Bank, que había comprado también Morgan Grenfell de Londres en 1989. La compra hecha por Deutsche Bank el mayor banco del mundo en ese momento con activos de $ 882 mil millones de dólares. En enero de 2002, el japonés Mitsubishi y Sumitomo Operations se combinaron para crear Mitsubishi Sumitomo Bank, que superó a Deutsche Bank, con activos de US $ 905 mil millones de dólares. [8]

En 2004 HSBC se había convertido en el segundo mayor banco del mundo. Seis años más tarde, los tres gigantes habían sido eclipsados por BNP y Royal Bank of Scotland.

En los EE.UU., la pesadilla de George Gould llegó a su punto más alto justo a tiempo para el nuevo milenio, cuando el Chase Manhattan absorbió Chemical Bank. Bechtel Wells Fargo compró Norwest Bank, mientras que Bank of America absorbió Nations Bank. El golpe de gracia llegó cuando la reunificación de la Casa de Morgan anunció que se fusionaría con el Chase Manhattan Bank de Rockefeller/Chemical Bank/Manufacturers Hanover.

Cuatro bancos gigantes emergieron para reinar en el mercado financiero de Estados Unidos. JP Morgan Chase y Citigroup fueron los reyes del capital de la Costa Este. En conjunto, estos dos bancos controlaban 52,86% de la Reserva Federal de Nueva York [9] mientras Bank of America y Wells Fargo reinaban en la Costa Oeste.

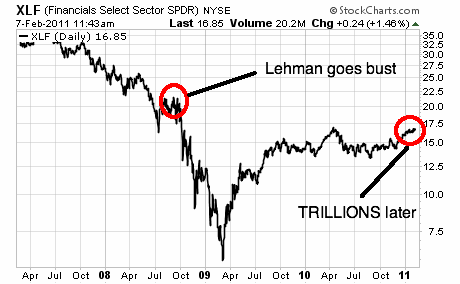

Durante la crisis bancaria de 2008 estas empresas crecieron aún más, recibiendo casi $ 1 trillón de dólares cortesía del gobierno de Bush y el secretario del Tesoro y ex de Goldman Sachs, Henry Paulsen, mientras que silenciosamente compraban activos por centávos de dólar.

Barclays se hizo cargo de Lehman Brothers. JP Morgan Chase se tragó a Bear Stearns y Washington Mutual. Bank of America tomó a Merrill Lynch y Countrywide. Wells Fargo se apoderó del quinto más grande banco del país, Wachovia.

Los mismos bancos controlados por las mismas ocho familias que durante décadas habían galopado sus Cuatro Jinetes del petróleo por el Golfo Pérsico son ahora más poderosas que en cualquier otro momento de la historia. Son los Cuatro Jinetes del Sistema Bancario Mundial.

Fuentes:

[1] The Great Crash of 1929. John Kenneth Galbraith. Houghton, Mifflin Company. Boston. 1979. p.148

[2] Ibid

[3] Evening Edition. National Public Radio. 2-27-95

[4] “Bank of America will Purchase Chicago Bank”. The Register-Guard. Eugene, OR. 1-29-94

[5] “Big-time Bankers Profit from M&A Fever”. Knight-Ridder News Service. 12-30-95

[6] “US Banks find New Opportunities in the Middle East”. Amy Dockser Marcus. Wall Street Journal. 10-12-95

[7] “Making a Money Machine”. Daniel Kadlec. Time. 4-20-98. p.44

[8] BBC World News. 1-20-02

[9] Rule by Secrecy: The Hidden History that Connects the Trilateral Commission, the Freemasons and the Great Pyramids”. Jim Marrs. HarperCollins Publishers. New York. 2000. p.74