Manipulated Markets Make a Come Back

August 10, 2011

Does it make sense that during the deepest depression since 1929, the U.S. Stock Market comes back up from a 6oo+ point decline? Only a manipulated system where speculators have complete control could recover from a rout that showed how little confidence investors have in the market today.

by Luis R. Miranda

The Real Agenda

August 9, 2011

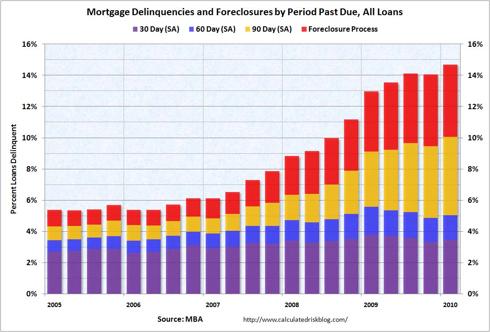

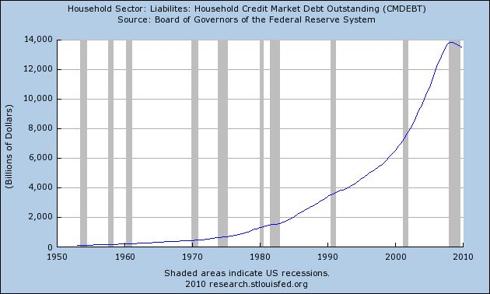

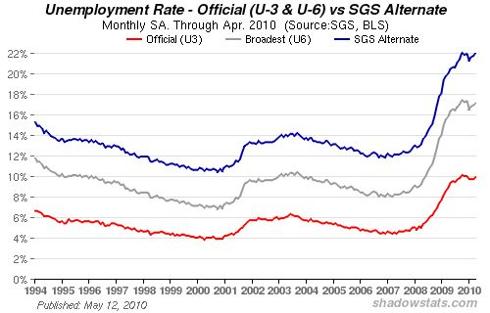

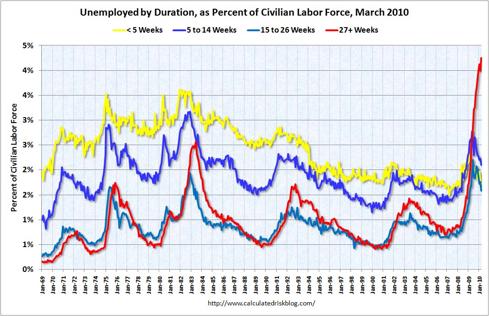

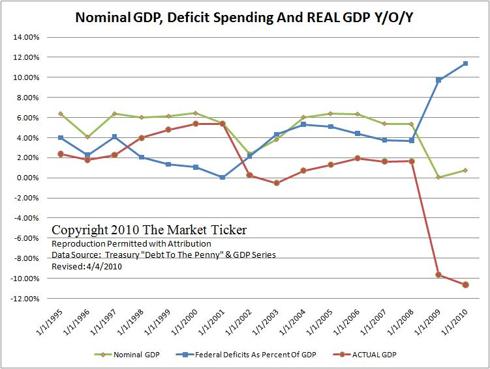

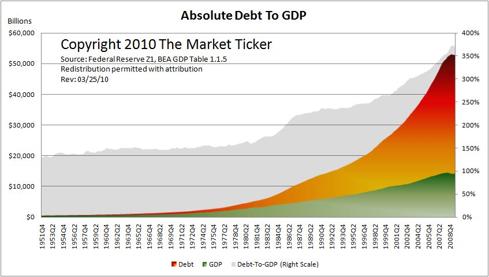

While countries are in dire straits to make payments on mostly illegally acquired debts and the price of oil continues to fall; while little to nothing is produced or manufactured in the industrialized world and no ingenuity makes it big anywhere in the world; while the most important currencies continue to tumble and other financial markets turn more sour; while unemployment continues to grow from the low 20′s and more people make use of food stamps and unemployment benefits; while more jobs are exported to third world nations that support slave work for their populations and inflation is only tamed by artificial manipulation of the currencies; while numerous people look to gold and silver as their salvation, surprisingly the stock market came back from the pantheon and surged to recover from the slide seen just a few hours ago.

There is very little that can't be done when someone or something controls fiat currencies, rating agencies, and financial markets.

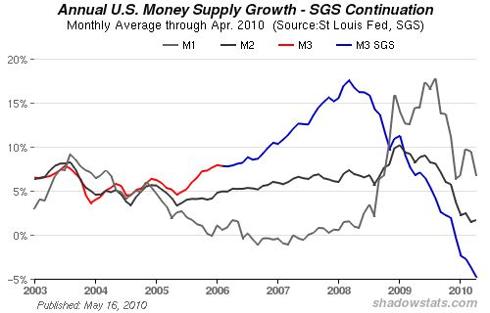

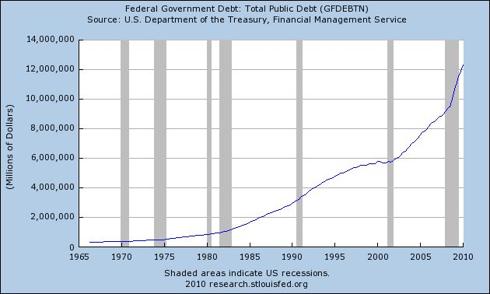

But not only did the stocks came back strong; they had the largest gains in more than two years. Along with this “come back” the U.S. dollar got weaker and the Swiss franc rose the most since 1971. Even the very same Standard & Poor Index managed to recover almost 5 percent, the most significant gains since 2009. In the meantime, the origin of the financial disaster, the privately owned banks headed by the Federal Reserve announced their intent to print more worthless money into the economy as a way to “boost” confidence. Even though QE1 and QE2 failed to provide any confidence, or for that matter failed to provide anything positive, the FED believes it is appropriate to bring up QE3. With this, the FED shows its interest to purchase more government bonds, which will consolidate its position as the largest holder of U.S. government debt.

“The Fed is clearly setting up a situation that could offer them the potential to do something significant, if necessary,” Bruce McCain, who helps oversee $22 billion as chief investment strategist at the private-banking unit of KeyCorp in Cleveland, said in a telephone interview. “That could be viewed as a positive,” added McCain. “People are starting to realize that what we’ve had in the market was an overreaction.” Really? Positive? How so?

Artificial Surge after the Decline

How can a stock market come back from a 600+ point decline in just a few hours if one considers that the cause of such loss -the downgrade of the U.S. debt rating- has not been dealt with? It simply boggles the mind, doesn’t it? The United States credit rating was lowered from AAA to AA+ by Standard & Poors, a rating agency that is paid by the banks to evaluate financial products and which is in part responsible for the current financial catastrophe. Together with Moody’s, S&P was created the by the banking system to carry out “independent” evaluations of financial products as well as credit confidence on institutions, state and local governments and of course whole nations.

According to Bloomberg, Stocks came back from a loss of $ 1 trillion after S&P downgraded the U.S. credit rating last Friday evening. The results of the downgrade were not felt until Monday, when the Markets opened all over the world. The S&P index sank about 11 percent and the stock market lost 648 points or more than 6 percent. But just 24 hours later, everything was different. “The MSCI All-Country World Index rose 2.1 percent for its biggest gain of the year”, says Bloomberg. “The index started the U.S. session valued at about 12.1 times profits, down from 21 in 1995..The MSCI Emerging Markets Index pared today’s drop to 2.2 percent after tumbling as much as 4.4 percent.”

Stocks Rally? What Rally?

In the Stock Market, the Dow Jones climbed almost 430 or 4 percent, failing to completely recover from the recent loss. The stocks experienced the 1oth more significant gain in its history. Can you believe it? In the middle of a Depression, the stocks rally the much?

Meanwhile, in the S&P, shares got to the front of the line due to the numerically significant gains. In total, they accumulated some 8.2 percent all together. This is the biggest rally since May 2009, which meant a complete recovery from Monday’s low. Bank of America Corp., which is now being sued by AIG for fraud, managed to gain 17 percent while other players like Hartford Financial Services got back 16 percent.

Of course the main stream media is giving all credit to the Federal Reserve, due to its announcement that it intends to “boost” the economy by injecting worthless cash into it. The FED’s head, Ben Bernanke and his aides came out to try to calm the demise a bit, although not everyone at the FED agreed with the move to bring along a new quantitative easing move. Three members from the policy committee dissented and instead called for maintaining interest rates low for a longer period of time.

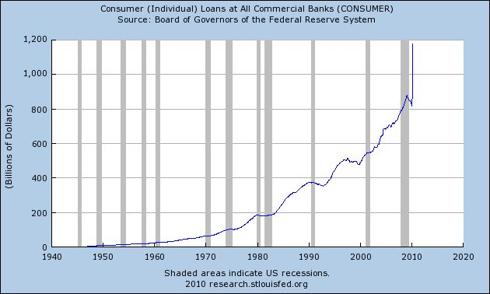

As the docu-film “The Inside Job” impeccably exposes, there is very little that can’t be done when someone or something has the power to create money out of thin air, create rating agencies, control those agencies to give AAA ratings to whatever they choose and electronically manipulate the financial stock and bond markets whenever it’s convenient in order to perpetuate the fraudulent debt-based system the world has worked under since 1913.

False Policy Changes

The best way to perpetuate the above cited financial system is to have the available tool continuously reinforce the falsehood of the Central Bank sponsored plans. So, Moody’s has come out to praise the FED’s move to maintain the interest rates at a quarter of a percent in order to bolster the downturn. It’s a ”major policy change,” said Augustine Faucher, director of macroeconomics at Moody’s. “By providing a more explicit time line for raising rates, the Fed is telling markets it is concerned about recent economic weakness and the potential for a near-term contraction, and is dedicated to spurring stronger economic growth,” Faucher added.

Just as this statement by Faucher is baseless, so is the belief that because the U.S. dollar is the world’s reserve currency, it can stand more beating than any other one. In fact, one of the reasons why the U.S. has not been downgraded further is that its currency is still consider valuable. Ironically, the dollar has lost 98 percent of its value since it became the subject of manipulation by the bankers. Moody’s has stated that the U.S. dollar can support larger levels of debt than other currencies. How do they figure that with a currency that is so devalued. They can’t figure it out. They just make it up.

Just as this statement by Faucher is baseless, so is the belief that because the U.S. dollar is the world’s reserve currency, it can stand more beating than any other one. In fact, one of the reasons why the U.S. has not been downgraded further is that its currency is still consider valuable. Ironically, the dollar has lost 98 percent of its value since it became the subject of manipulation by the bankers. Moody’s has stated that the U.S. dollar can support larger levels of debt than other currencies. How do they figure that with a currency that is so devalued. They can’t figure it out. They just make it up.

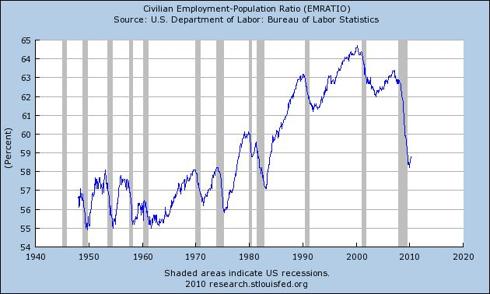

The one world reserve currency scheme is only beneficial to those who control it, because the rest of the nations need to do business while devaluing their own. In sound economics, the value of paper money is based on a country’s production or manufacturing, therefore, the U.S. dollar can no longer be such reserve currency. U.S. manufacturing has eroded so badly, that it has cost the jobs of some 18 million people in the last few years.

If the U.S. dollar is still the world’s reserve currency, why are there other currencies that have better exchange rates than the dollar itself? I am no economic expert, but if the Swiss Frank rates higher than the dollar in currency exchange markets, shouldn’t the Frank be the reserve currency? Or even better, shouldn’t a commodity like gold be the reserve currency given its capacity to withstand recessions, depressions and financial market manipulations? It should. The reason why gold is not the reserve currency or at least the commodity over which a paper money currency is supported is that bankers cannot monopolize it, “hug” it or manipulate it.

High Market but Low Results: The World Economy in Shambles

While the banks try to extend the suffering period for the middle and low classes, countries in Europe are scrambling for a life boat to jump on. Although France and Germany are said to be negotiating an agreement to buy Spain’s and Italy’s debt in order to avoid a deeper economic collapse, some sources claim that the rescuers believe the Italian debt is too large to save. Both Nicolas Sarkozy and Angela Merkel began to hear opposition voices that are calling for a different position from the German and French governments. The reason for this is that an eventual bailout of Italy and Spain could cost the rescuers their AAA rating. This is seen as a possible trigger to drag the world’s economy further into the precipice.

Although U.S. markets artificially revived themselves on Tuesday, other countries were not as lucky. In Italy, the bond market saw a loss of 11 percent on its 10 year note. Just as the FED has done in the United States, the European Central Bank kept Italy and Spain afloat through the purchase of their bonds for a second day in a row. That was not enough to save the Spanish 10 year notes, as they collapsed eight basis points to 5.08 percent on Tuesday.

Meanwhile, oil prices hit some of the lowest levels for the year by getting down to $79.30 a barrel. Conversely, gold prices soared and added 4.1 percent to get to a record price of $1,782.50 an ounce.