How Globalism Destroys Jobs, Businesses And Wealth

July 14, 2011 1 Comment

American Dream

July 14, 2011

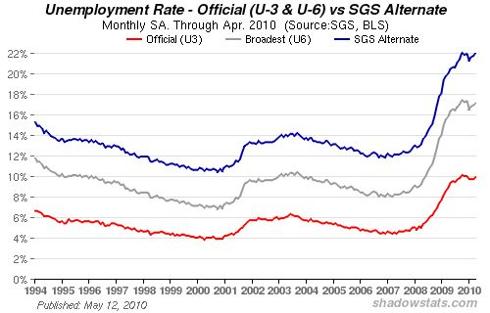

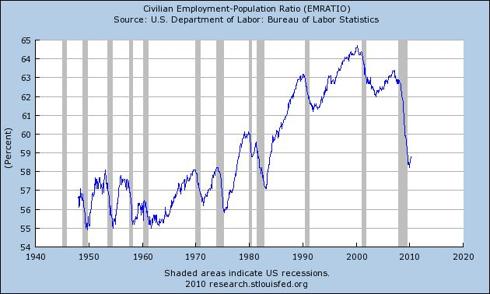

As most Americans stand around waiting for the U.S. economy to return to “normal”, there is a never ending parade of jobs, businesses and wealth heading out of the United States. The jobs and businesses that are leaving are gone for good and will not be coming back. This is causing unemployment to soar and government debt to skyrocket but our politicians are doing nothing about it. Instead, politicians from both parties keep insisting that they will solve all of our problems if we will just give them our votes.

Meanwhile, American families continue to fill up their shopping carts with cheap plastic crap made on the other side of the world. Globalism is slowly destroying the greatest economic machine that the world has ever seen and most Americans don’t even realize it. Today, the U.S. government has surrendered massive amounts of economic sovereignty to global organizations such as the WTO, the IMF and the World Bank. The United States has also entered into a whole host of very damaging “free trade agreements” such as NAFTA that are costing our economy huge numbers of jobs. Our politicians always promised us that globalism would bring us to a new level of prosperity, but instead that “giant sucking sound” that you hear is the sound of the U.S. economy being hollowed out.

Our politicians and the talking heads in the mainstream media always seem to be puzzled as to why there seems to be such a lack of jobs in this country.

But it really is no great mystery.

Jeffrey Pfeffer recently wrote an article for Fortune in which he stated the following….

The U.S. seems to be shocked that its economy isn’t creating many jobs, and each monthly report on the unemployment rate and the number of new jobs somehow stimulates more handwringing. I’m not an economist, labor or otherwise, but simple observation suggests one significant contributor to the nation’s job crisis — for a long time, maybe even decades, we have been waging war on jobs and those who hold them.

That is exactly what the policies of the U.S. government have been doing for decades – they have been waging war on jobs.

Both political parties have been eagerly pushing us into a globalized economy. Both political parties have told us not to worry as thousands of businesses, millions of jobs and trillions of dollars have left the country.

Well, so much damage has been done by this point that more Americans than ever are starting to wake up and realize that maybe globalism is not such a great thing after all.

Here is how globalism has destroyed our jobs, our businesses and our national wealth in 10 easy steps….

#1 Globalism has merged the U.S. economy with economies that allow slave labor wages.

The “minimum wage” became a whole lot less meaningful once we merged our economy with the economies of nations where it is legal to pay workers 50 cents an hour.

American workers have enjoyed all of the cheap products that have come flooding into our shores, but our politicians never told them that globalism would also mean that they would soon be directly competing for jobs with workers on the other side of the globe that are willing to work for 5 or 10 percent as much.

One big, global labor pool means that the standard of living of the hundreds of millions of workers on the other side of the world will come up slightly while the standard of living of American workers will come crashing down at a blinding pace.

Advocates of globalism never can seem to explain how U.S. workers are supposed to compete with teenage workers in Vietnam that often work seven days a week for as little as 6 cents an hour making promotional toys for big corporations.

#2 U.S. companies make bigger profits by sending jobs overseas.

If U.S. corporations can find a place where they can legally pay workers slave labor wages, what do you think they are going to do?

Corporations have a “duty to maximize shareholder wealth” and U.S. government policies actually have the effect of encouraging the offshoring of jobs.

This is even happening in industries that are on the cutting edge of new technology.

Andy Grove, the former CEO of Intel, says that our advanced technology companies are creating far more jobs overseas than they are in the United States….

Some 250,000 Foxconn employees in southern China produce Apple’s products. Apple, meanwhile, has about 25,000 employees in the U.S. That means for every Apple worker in the U.S. there are 10 people in China working on iMacs, iPods, and iPhones. The same roughly 10-to-1 relationship holds for Dell, disk-drive maker Seagate Technology (STX), and other U.S. tech companies.

#3 Globalism has allowed foreign countries to dominate a whole host of industries that used to be dominated by the United States.

U.S. companies are having an incredibly difficult time competing against the low labor costs and the much less stringent business regulations found on the other side of the globe.

In May, the United States spent 50 billion dollars more on goods and services from the rest of the globe than they spent on goods and services from us.

This happens month after month after month.

Every month we get tens of billions of dollars poorer and the rest of the world gets tens of billions of dollars richer.

We are getting clobbered even in industries that we invented.

Do you remember when the United States was the dominant manufacturer of automobiles and trucks on the globe? Well, in 2010 the U.S. ran a trade deficit in automobiles, trucks and parts of $110 billion.

In 2010, South Korea exported 12 times as many automobiles, trucks and parts to us as we exported to them.

How did this happen?

Well, there are a lot of reasons, but one big reason is that the business environment in the United States has become incredibly toxic. Businesses in this country face a nightmarish web of rules and regulations and that is a big reason why so many businesses are choosing to leave this country.

In a recent article for Forbes, John Mariotti made a list of just a few of the bureaucracies that U.S. businesses must contend with on a daily basis….

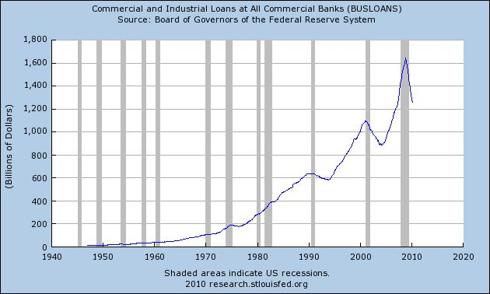

#4 Jobs and manufacturing infrastructure are being lost at an astounding pace and they are not going to come back.

Jobs and manufacturing facilities are leaving this country at a blinding pace. Nothing is being done to stop this from happening. These jobs are not coming back and they are not being replaced.

Just consider the following statistics….

*The United States has lost a staggering 32 percent of its manufacturing jobs since the year 2000.

*Between December 2000 and December 2010, 38 percent of the manufacturing jobs in Ohio were lost, 42 percent of the manufacturing jobs in North Carolina were lost and 48 percent of the manufacturing jobs in Michigan were lost.

*The United States has lost an average of 50,000 manufacturing jobs per month since China joined the World Trade Organization in 2001.

*Since 2001, over 42,000 manufacturing facilities in the United States have been closed down.

So what are all of those workers doing today?

There are sitting at home trying to figure out what has happened to the once happy lives that they enjoyed.

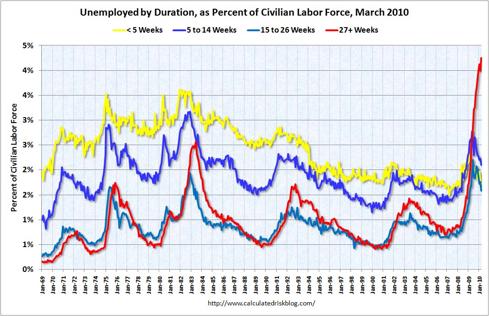

Today, there are 6.3 million Americans that have been unemployed for more than 6 months. That number has risen by more than 3.5 million in just the past two years.

Right now, it takes the average unemployed worker almost 40 weeks to find a new job. There are not nearly enough jobs for everyone and the competition for the few job openings that are available is brutal.

Only 66.8% of American men had a job last year. That was the lowest level that has ever been recorded in all of U.S. history.

We have millions upon millions of very hard working Americans that are sitting around hoping that someone will give them a job.

But labor costs about 10 percent as much on the other side of the world so that is where all the jobs are going.

#5 Workers without good jobs can’t buy houses or cars.

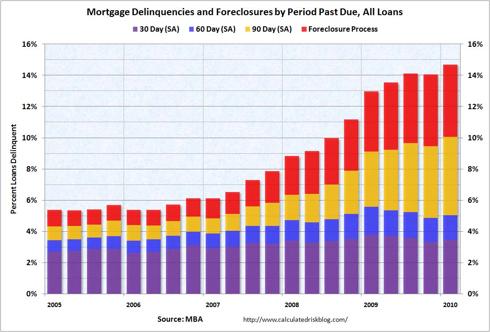

A huge factor in the housing crash has been the lack of good jobs. There are now approximately 10 percent fewer middle class jobs than there were a decade ago.

As competition for jobs increases, wages are being depressed because employers know that they have all the power.

So working class American families are being squeezed like never before.

Only the top 5 percent of U.S. households have earned enough additional income to match the rise in housing costs since 1975. A nice home is becoming out of reach for a lot of Americans.

Meanwhile, the cost of food and the cost of gas continue to rise.

One recent survey found that 9 out of 10 U.S. workers do not expect their wages to keep up with soaring food prices and soaring gas prices over the next 12 months.

#6 If American workers don’t have jobs they aren’t paying taxes.

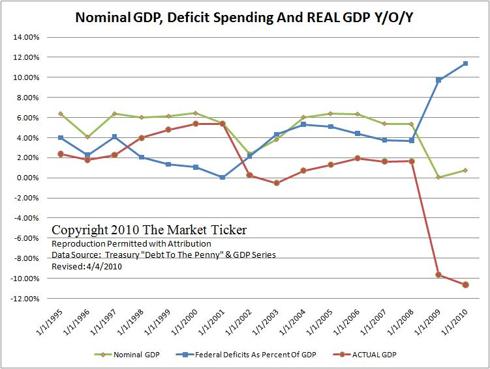

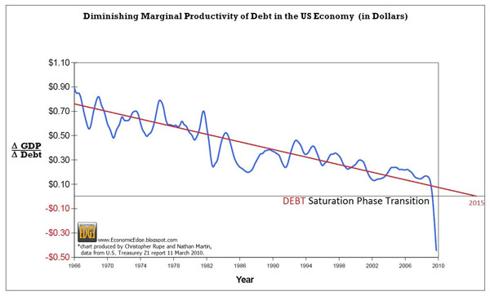

Most Americans have no idea how much our trade deficit contributes to our government debt problems. When Americans are not working, they are not paying taxes to support our federal, state and local governments.

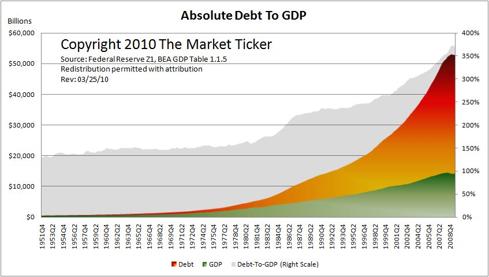

In the years since 1975, the United States had run a total trade deficit of 7.5 trillion dollars with the rest of the world.

That is money that could have gone to U.S. workers and U.S. businesses. That is money that taxes could have been paid on.

Instead, our workers are sitting at home and our federal, state and local governments are starving for cash.

#7 Instead of receiving taxes, the government must pay out money to our unemployed workers instead.

We are going to support our unemployed workers one way or another. Either we are going to give them good jobs or we are going to give them welfare payments.

During the recent economic downturn, millions of American workers have been receiving unemployment benefits for up to 99 weeks. It has become soul-crushingly difficult to find a job in America today, and we have developed a whole new class of people that have become totally dependent on the government because they simply cannot find work.

Everywhere you look, government anti-poverty programs are exploding in size.

As 2007 began, there were 26 million Americans on food stamps. Today, there are more than 44 million Americans on food stamps, which is a new all-time record.

#8 As jobs and businesses leave our shores, many of our once great manufacturing cities have been transformed into hellholes.

In a recent article entitled “American Hellholes“, I talked about the economic decay that we are seeing all over the United States….

All over the nation many of our greatest cities are being slowly but surely transformed into post-apocalyptic wastelands. All over the mid-Atlantic, all along the Gulf coast, all throughout the “rust belt” and all over the entire state of California cities that once had incredibly vibrant economies are being turned into rotting, post-industrial hellholes. In many U.S. cities, the “real” rate of unemployment is over 30 percent. There are some communities that will start depressing you almost the moment that you drive into them. It is almost as if all of the hope has been sucked right out of those communities. If you live in one of those American hellholes you know what I am talking about. Sadly, it is not just a few cities that are becoming hellholes. This is happening in the east, in the west, in the north and in the south. America is literally being transformed right in front of our eyes.

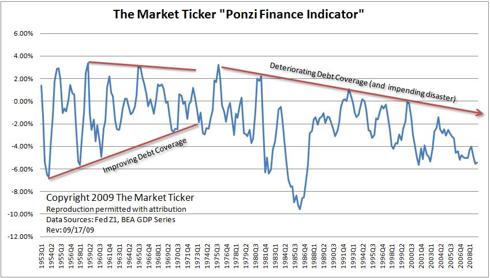

#9 The United States ends up borrowing back most of the money that it sends overseas every single month.

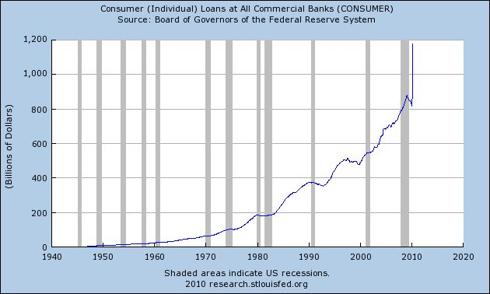

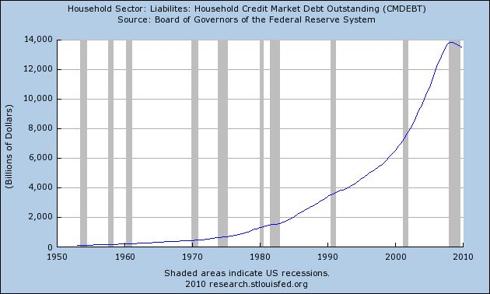

Every month tens of billions of dollars of our national wealth gets transferred to foreign countries. In order to make ends meet, our federal, state and local governments end up borrowing gigantic amounts of money from the countries that we have sent our wealth to.

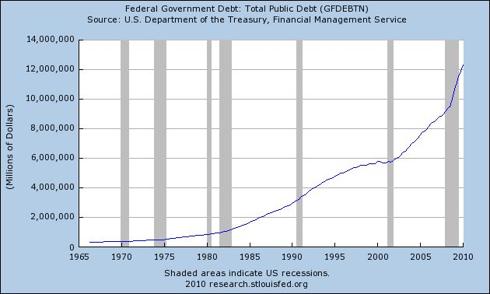

So now we have a national debt that is well over 14 trillion dollars and we owe massive amounts of money to countries like China and Saudi Arabia.

But when we borrow money from other countries that makes us even poorer in the long run. Debt is never the answer to anything.

#10 Foreign countries are using up some of the wealth that we send them every month to buy up our infrastructure.

Most Americans don’t realize that our state and local governments are selling off our infrastructure piece by piece. Foreign governments are literally buying pieces of America with the money that we keep sending to them. In a recent article entitled “Our Politicians Are Selling Off Pieces Of America To Foreign Investors – And Goldman Sachs Is Helping Them Do It“, I talked about this phenomenon….

State and local governments across the country that are drowning in debt and that are desperate for cash are increasingly turning to the “privatization” of public assets as the solution to their problems. Pieces of infrastructure that taxpayers have already paid for such as highways, water treatment plants, libraries, parking meters, airports and power plants are being auctioned off to the highest bidder. Most of the time what happens is that the state or local government receives a huge lump sum of cash up front for a long-term lease (usually 75 years or longer) and the foreign investors come in and soak as much revenue out of the piece of infrastructure that they possibly can. The losers in these deals are almost always the taxpayers. Pieces of America are literally being auctioned off just to help state and local governments minimize their debt problems for a year or two, but the consequences of these deals will be felt for decades.

Sadly, neither political party seems concerned about the effects of globalism at all.

In fact, both parties continue to push for even more globalism.

But large numbers of ordinary Americans are waking up.

According to a recent Washington Post poll, only 36 percent of Americans consider “the increasing interconnection of the global economy” to be a positive thing. Back in 2001, 60 percent of Americans believed that the globalization of the economy was a positive thing.

So maybe there is a glimmer of hope.

But until fundamental changes are actually made, globalism will continue to destroy our jobs, our businesses and our national wealth.