Nova Ordem Econômica e Política Mundial à Vista

March 24, 2011

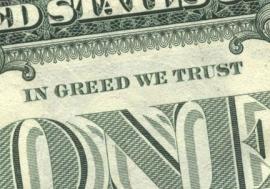

George Soros tem a intenção de cooptar os países do terceiro mundo, apelando para a participação dos países em desenvolvimento como parte da solução. O controle do novo sistema, no entanto, permanecera nas mãos dos globalistas como ele e seus fantoches eleitos em cada país.

Business & Media Institute

Adaptação de Luis R. Miranda

23 Março, 2011

Em 08 de abril, um grupo financiado com 50 milhões de dólares de contas bancárias de George Soros organizou uma importante conferência econômica e a meta para este evento é “estabelecer novas normas internacionais” e “reforma do sistema monetário.” É tudo de acordo com um plano publicado em uma coluna de 04 de novembro de 2009, onde Soros disse que havia uma necessidade de “reordenar muita coisa no sistema financeiro”.

Globalista e bilionário George Soros

O evento de abril reunirá “mais de 200 acadêmicos, empresários, políticos e burocratas para repetir a famosa reunião de 1944 chamada de Bretton Woods, que ajudou a criar o Banco Mundial e o Fundo Monetário Internacional. Soros quer um “sistema multilateral” ou um novo sistema econômico em que os EUA não seja tão dominante. Esse lugar será ocupado pela China comunista.

Mais de dois terços dos oradores programados têm ligações directas a Soros. O bilionário que acredita que “o principal inimigo da sociedade aberta, creio eu, já não é o comunismo, mas a ameaça capitalista”. Isto não é surpreendente, já que Soros apoia uma regulamentação comum e disse que a China é o modelo em termos de controle monetário, econômico e populacional, entre outros.

Até agora, esta reunião global tem gerado menos publicidade do que um concurso de ortografia. Isso ocorre apesar de ter pelo menos quatro jornalistas na lista de oradores, incluindo um editor do Financial Times e os editores da Reuters e The Times. Considerando-se as advertências de Soros do que poderia acontecer sem um novo acordo, esta pouca divulgação deve ser um grande problema. Mas não é.

O que é um grande problema é que Soros está fazendo exatamente o que ele queria. O seu comentário de 2009, pressionou por uma “nova conferência de Bretton Woods, incluindo a criação da nova estrutura financeira pós-Segunda Guerra Mundial.” E ele tinha fixado as rodas em movimento. A ordem financeira mundial criada após a guerra, e através da qual os globalistas adquiriram tudo, foi a mesma que estabeleceu os EUA como o único super poder, e agora esta mesma diretriz quer ser usada para instalar a China como a cabeça do novo sistema globalista.

De fato, a América tem sido utilizada pelos globalistas para avançar suas agendas de conquista usando sua influência militar e econômica para promover a desregulamentação financeira que lhes permitiu controlar a sociedade global. A utilização de um sistema que no começo tinha tintes capitalistas, mas que nunca atingiu o seu potencial, tornou-se corporativista, baseado no controle corporativo dos governos que hoje perpetua a centralização do poder econômico, político e militar.

Apenas uma semana antes que este editorial ser publicado, Soros havia fundado o Instituto de Novo Pensamento Econômico (INET), em Nova York, o grupo anfitrião da conferência no Mount Washington Resort, o hotel que abrigou primeira reunião. A mais recente foi realizada na Universidade Central Européia em Budapeste. CEU recebeu 206 milhões de dólares de Soros em 2005 e tem 880 milhões a mais do seu fundo, de acordo com o The Chronicle of Higher Education.

Isto, também, é uma reunião de fantoches do Soros. INET terá personalidades como o ex-primeiro-ministro britânico, Gordon Brown, o ex-presidente do Fed, Paul Volcker e Soros, para produzir “um monte de idéias de alta qualidade.”

Apesar que INET diz que mais de 200 estarão presentes na conferência, apenas 79 oradores estão inscritos no seu site – e já se parece com uma convenção Soros. Vinte e dois são membros do INET e outros três tem bolsas de Soros. Dezenove outros empregados são listados como membros da operação Project Syndicate; segundo eles uma -”fonte preeminente do mundo dos comentários originais de opinião” que inclui 456 jornais de grande circulação em 150 países e é financiado pelo Open Society Institute propiedade do Soros. Isso é apenas o começo.

Entre os palestrantes estão:

* Volcker é presidente do conselheiro econômico do presidente Obama. Ele escreveu o prefácio para o um dos mais conhecidos livros de Soros, “A Alquimia das Finanças” e elogiou o Soros como “um especulador de sucesso” que escreveu “com visão e paixão” sobre as questões da globalização.

* O economista Jeffrey Sachs, diretor do Instituto da Terra e destinatário da caridade Soros. Sachs, recebeu 50 milhões de dólares do Soros para o Projeto do Milênio das Nações Unidas, que também dirige. Sachs é reconhecido internacionalmente por sua economia liberal. Em 2009, por exemplo, queixou-se dos impostos nos EUA, que segundo ele eram muito baixos, dizendo que os EUA “tinha que aumentar os impostos, sem dúvida. Este é um evento Soros, de cima para baixo. Mesmo Soros admite que suas ligações com o INET sao um problema, e diz, “há um conflito de interesse que eu reconheço plenamente.” Ele diz que fica de fora das operações. Isso é impossível. Todo o evento é financiado e explorado por ele.

Ex-economista do Banco Mundial, Joseph Stiglitz, um amigo de Soros que uma vez falou do desastre causado pelo Banco Mundial, é parte do evento.

INET não é sutil sobre suas metas para a conferência. Quando entrevistado, Robert Skidelsky, membro do conselho de INET, sobre a necessidade de uma nova Bretton Woods, em um vídeo recente, Skidelsky nao poupou comentários a favor disto. O slide de introdução para o vídeo fala sobre como a questão da moeda e da tensão entre os EUA e a China estão renovando as chamadas para uma reforma financeira global. ” Skidelsky pediu um novo acordo e disse no vídeo que o conflito entre os EUA e a China estava “no centro de qualquer acordo financeiro que possa ser negociado, que precisa ser negociado.”

Soros describiu no editorial em 2009 que o conflito entre os EUA e a China é “outra escolha difícil entre duas maneiras fundamentalmente diferentes de organização: capitalismo internacional e capitalismo de Estado (comunismo). Ele concluiu que “um novo sistema multilateral baseado em princípios mais sólidos deve ser inventado.” Conforme ele explicou, em 2010, “precisamos de um xerife global”.

Na versão 2000 do seu livro Open Society: Reforma do Capitalismo Global”, Soros escreveu sobre como as instituições de Bretton Woods” falharam dramaticamente ” durante a crise econômica no final de 1990. Quando pediu um novo Bretton Woods em 2009, queria “restaurar o Fundo Monetário Internacional, e à reestruturação das Nações Unidas para instar a China e outros países.

“A reorganização da ordem mundial se estende além do sistema financeiro e o envolvimento das Nações Unidas, especialmente os membros do Conselho de Segurança”, escreveu ele. “Esse processo deve ser iniciado por EUA, mas a China e outros países em desenvolvimento devem participar de forma igualitária.”

Soros destacou que este ponto tem que ser uma solução global, fazendo com que os Estados Unidos seja parte da lista. “Potências emergentes devem estar presentes na criação deste novo sistema para garantir que eles são contribuintes ativos.”

E isso é exatamente o tipo de detalhes que INET está publicando no seu site, com ênfase na “reconstrução da União Europeia e os emergentes da Europa Oriental, América Latina e Ásia. “Nestes planos, a China é preeminente, com personagens como um economista sênior do Banco Mundial em Pequim, o diretor da Academia Chinesa de Ciências Sociais, o principal conselheiro da Comissão Reguladora Bancária da China e do Director do Centro de Negócios Estrangeiros EUA-China. Todos eles defendem as velhas e conhecidas políticas globalistas que procuram que os países industrializados paguem novas iniciativas de gastos, especialmente nas áreas de energia sustentável, alterações climáticas, educação e alívio para os pobres.

* Um amigo de Soros, Joseph E. Stiglitz, antigo vice-presidente e economista-chefe do Banco Mundial e ganhador do Prêmio Nobel em Economia tem a mesma opinião que Soros. Ele criticou economistas de livre mercado, que ele chama de “fundamentalistas do mercado livre.” Naturalmente, Stiglitz faz parte do INET e é um contribuinte do Project Syndicate.

* O director executivo do INET Rob Johnson, um ex-presidente da Soros Fund Management, que faz parte do Conselho de Administração do Economic Policy Institute se queixou de que a intervenção do governo na crise fiscal não era suficiente e quis “reestruturação”, incluindo a aplicação “de cartas de demissão de altos executivos de todos os grandes bancos”.

Tudo isso é fácil de fazer quando você tem disponível o George Soros, que financia mais de 1.200 organizações. Só que nenhum destes grupos poderia organizar um evento como esse. Grupos como o MoveOn.org e o Center for American Progress não se tornaram proeminentes pela sua discreção. O mesmo acontece a nível mundial, onde Soros doou mais de 7.000 milhões de dólares para a Open Society Foundations – incluindo meios de comunicação que estão apenas a um telefonema de distância.

George Soros quer que China seja a nova superpotência. Depois de Bretton Woods e até hoje, globalistas como Soros usaram Estados Unidos como instrumento para controlar a sociedade global.

Por que é que estes meios controlados por Soros não publicaram informações sobre o evento? Afinal, Soros advertiu que tudo isso tem que acontecer, porque “a alternativa é assustadora.” O bilionário, que odeia George W. Bush disse que “a América é assustadora, porque uma superpotência em declínio político e econômico, mas que ainda mantém a supremacia militar é uma coisa perigosa.”

O império de Soros não diz nada sobre esta nova conferência de Bretton Woods, uma vez que não só é projetada para mudar as regras econômicas globais. Ela também é projetada para colocar a América em seu lugar, como parte de um mundo multilateral da maneira que Soros quiser. Ele escreveu que os EUA “Pode dirigir um esforço cooperativo para incluir os países desenvolvidos e em desenvolvimento e, assim, restaurar a liderança norte-americana de uma maneira aceitável.”

Isto é o que esta conferência quer: mudar a economia mundial e os EUA para serem “aceitáveis” para George Soros.