Vatican Calls for Global Authority on Economy

October 24, 2011 4 Comments

Document also calls for “Central World Bank” while hypocritically repudiating “idolatry of the markets”.

By Luis R. Miranda

The Real Agenda

October 25, 2011

The Vatican called on Monday for the creation of a “global public authority” and a “global central bank” to govern over the financial institutions that according to the document have become outdated and often ineffective in dealing with crises. The document (see item # 3 An Authority over Globalization ) of the Vatican’s Department of Justice and Peace echoes calls from some of the participants’ at “Occupy Wall Street” as well as demonstrators and similar movements around the world who have protested against the economic crisis.

“Towards the Reform of International Monetary and Financial System in the context of a World Public Authority,” includes very specific details. For example, when it calls to establish a tax on financial transactions. “The economic and financial crisis which the world is going through calls everyone, individuals and peoples, to examine in depth the principles and the cultural and moral values at the basis of social coexistence,” says the document.

The statement condemned what it called “the idolatry of the market” and the “neoliberal thinking” that said appeared to have only technical solutions to economic problems. “In fact, the crisis has revealed behaviours like selfishness, collective greed and hoarding of goods on a great scale,” it says, adding that the world economy needs an “ethic of solidarity” between rich and poor .

The Vatican’s position is of course ironic, because the Vatican is one of the richest organizations in the world, that just as many corporations and financial institutions makes use of markets to invest its wealth. Just as characters like George Soros, Al Gore, Bill Gates and Michael Moore, the Vatican would want us to believe that a World Authority controlled by the usual suspects, whose function is to redistribute wealth, is the viable solution to end poverty and misery. It’s actually the opposite. The creation of a global entity with powers over the economic and political structures is what the world bankers and oligarchs have been calling for to acquire total control over the planet’s resources. There won’t be improvements in the economy or the structure if we bow to a global organization that can control it all. And such redistribution and equality is not to make us all equally rich, but to make us all equally poor.

“If no solutions are found to the various forms of injustice, the negative effects that will follow on the social, political and economic level will be destined to create a climate of growing hostility and even violence, and ultimately undermine the very foundations of democratic institutions, even the ones considered most solid,” it said.

Of course, this scenario is what the oligarchs who control much of the world’s wealth want. Street violence and hostility between social groups will give them the pretext to use force against citizens. No need to invade countries to use their weapons, as these are needed in domestic operations against citizens who lack a place to live and food to eat. Governments of major countries of the world have been preparing for this for many years. They have mounted an internal military structure to deal with the “troublemakers” that take to the streets to demand social justice and other collectivist scenarios in their despair to survive.

If it is difficult to believe that we are heading for an ending of the type described here, you should continue reading the Vatican document, which calls for the establishment of a “supranational authority,” with worldwide reach and “universal jurisdiction” to guide policy and economic decisions. What is this? Or more importantly, what does it mean? If globalization and integration of regions in Europe, Asia and America have failed miserably due to the significant loss of sovereignty of nations taking part in these movements, what can we expect if a supranational authority takes control of a and is given universal jurisdiction? And how will this authority be organized? Does the Vatican intend to become such supranational authority?

Asked at a news conference if the document could become a manifesto for protestors that have criticized the global economic policies, Cardinal Peter Turkson, head of the Department of Justice and Peace at the Vatican said: “The people on Wall Street need to sit down and go through a process of discernment and see whether their role managing the finances of the world is actually serving the interests of humanity and the common good. We are calling for all these bodies and organisations to sit down and do a little bit of re-thinking.”

One World Government

When this publication along with other alternative media warn about the existence of a world government, we are often called conspiracy theorists, however, the evidence that this entity exists is vast. In a recent article on Pravda.ru it is clearly portrayed how a small group of families really controls the world. In the article entitled “The Large Families that Rule the World”, the publication highlights how a few oligarchs own the most influential corporations, many of which have revenues exceeding that of most countries worldwide. In addition, the article establishes a clear link between these corporations and the banks that control the global financial system. Along with this article, The Real Agenda published a series of articles that show direct relationships between Wall Street, the corporations that control the industry and the planet’s resources and the families that own them. These items can be read in our website in the following order: The Four Horsemen of the Banking System, The Federal Reserve Cartel: The Eight Families, The Federal Reserve Cartel: A Financial Parasite, The Federal Reserve Cartel: The Roundtable and The Illuminati, The Federal Reserve Cartel: The U.S. Mason Bank and The House of Rothschild.

In a section that explains why the Vatican believes the reform of the global economy is necessary, the document says:

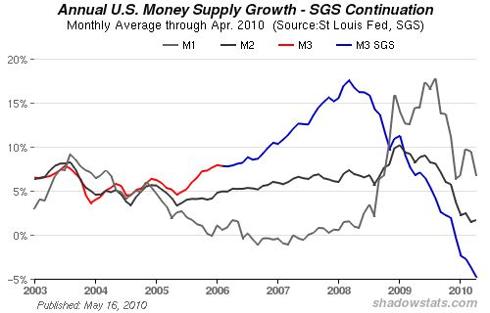

“In economic and financial matters, the most significant difficulties come from the lack of an effective set of structures that can guarantee, in addition to a system of governance, a system of government for the economy and international finance.” The document goes on to say that the International Monetary Fund (IMF) has no power or ability to stabilize global finances by regulating the money supply in general and is not able to watch over “the amount of credit risk assumed by the system.”

Towards the end, the letter from the Vatican insists that there should be a common set of minimum standards for managing the global financial market, as well as a form of global monetary management. This means a single currency, whose value will be issued under the power of that World Authority. Such a currency, as suggested in financial circles, would be digital, so the global society would function without paper money and only with digital transactions that would be carefully monitored by the World Authority through a centralized control system. This system would be under the power of the “global central bank” whose structure already exists.

The document adds that this change will take years to put in place. “Of course, this transformation will be made at the cost of a gradual, balanced transfer of a part of each nation’s powers to a world authority and to regional authorities, but this is necessary at a time when the dynamism of human society and the economy and the progress of technology are transcending borders, which are in fact already very eroded in a globalised world.”

As explained above, the installation of a global structure of control, as the Vatican promotes in his paper, has always been the result sought by global oligarchies. The transition from a society where the individual is free to a new one where nations lose their sovereignty and their citizens become subjects of an entity with global jurisdiction means the end of individual freedom and the collapse of countries as independent nations.

If there is something to be learned from the initiatives that seek political and economic unification at the regional and global levels, is that these initiatives are doomed to fail. This is seen in the current global economic and political crisis. So the solution is not more but less centralization. Countries must again function as separate entities trading with each other on a bilateral and multilateral basis, respecting their own laws and without eroding the constitutional rights and duties of its citizens.

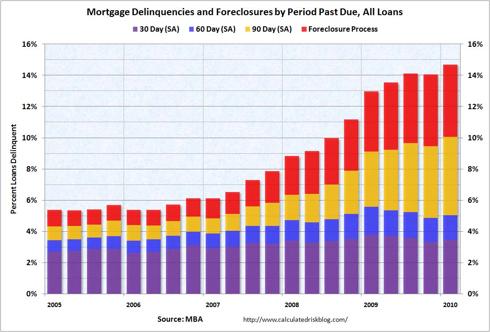

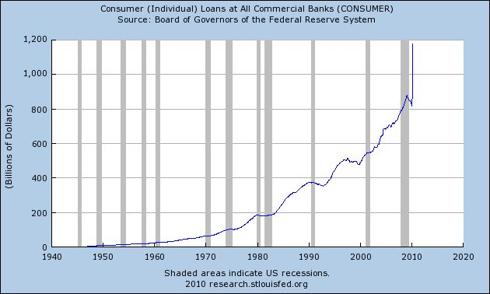

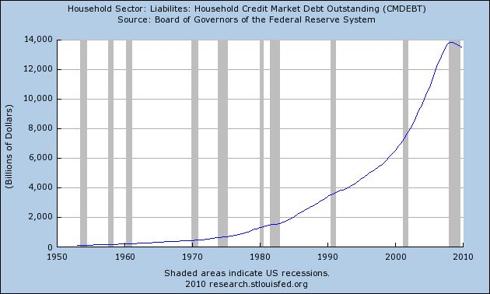

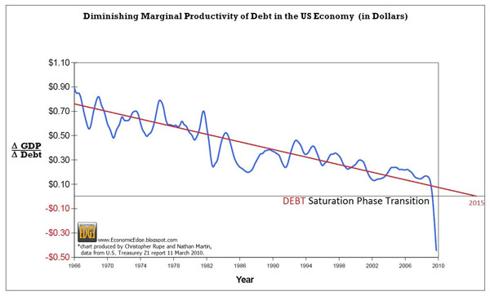

under the pressure of unpayable debt. Each day the safe haven of gold and silver related assets become more attractive. We ask where else do you go for safety? A conflagration is a fire out of control and that is exactly the conditions the world faces today. The inflationary depression has smoldered for 14 months and it will soon accelerate.

under the pressure of unpayable debt. Each day the safe haven of gold and silver related assets become more attractive. We ask where else do you go for safety? A conflagration is a fire out of control and that is exactly the conditions the world faces today. The inflationary depression has smoldered for 14 months and it will soon accelerate.